Listen to the Article: Experience the full content by listening to the audio version below.

It’s no secret that websites are becoming increasingly crucial for businesses of all sizes. A well-designed website can help you attract new customers and grow your business. But what are the accounting rules for capitalizing website design costs?

The first step is determining whether the costs are for website development or maintenance. Website development costs are capitalized, while website maintenance costs are expensed as incurred.

Capitalizing website design costs means including them as part of your company’s assets on the balance sheet. This treatment is generally reserved for costs that will provide benefits for more than one year.

To capitalize on website design costs, businesses must follow the same basic rules that apply to other types of capital assets, such as buildings or machines. The costs must be capitalized if they meet all of the following criteria:

1. The costs are incurred during the construction or development phase of the website.

2. The costs are necessary and directly related to the development or construction of the website.

3. The costs can be reasonably expected to generate economic benefits for the company over a year.

If the above criteria are met, businesses should then follow these specific guidelines for capitalizing website design costs:

1. Include all direct costs of developing or constructing the website, such as labor, materials, and outside services.

2. Do not capitalize indirect costs, such as overhead or general and administrative expenses.

3. Capitalize interest expenses incurred during the construction or development phase of the website.

4. Depreciate capitalized costs over the useful life of the website, which is typically three to five years.

Businesses should consult with their accountant or financial advisor to ensure they follow all applicable accounting rules when capitalizing website design costs.

What Qualifies a Website Design Cost as a Capital Expenditure?

Numerous factors make website design costs a capital expenditure. However, the most important qualification is the website’s ability to generate revenue. In other words, the website must have the potential to generate income for the company through online sales, advertising, or some other means. This is the key criterion that distinguishes a website design cost as a capital expenditure from other types of expenses.

Another essential factor to consider is the lifespan of the website. For example, a website that is designed to last for several years is more likely to be considered a capital expenditure than one that is only intended to be used for a short period. This is because the longer lifespan of the website indicates a greater investment of resources, which is typically associated with a capital expenditure.

Finally, the size and scope of the project are also important considerations. A large and complex website design project is more likely to be classified as a capital expenditure than a smaller and simpler one. This is because the larger project requires a greater investment of resources and typically has a longer lifespan.

In general, website design costs that meet all or most of the above criteria are more likely to be considered capital expenditures. This is because these types of projects have a greater potential to generate income and generate long-term value for the company.

Are There Any Cost Limits for Capitalizing Website Design Costs?

The process of website design can be a very costly one, and there are often cost limits that are associated with capitalizing these costs. For example, many companies will only capitalize on costs associated with the design of their website if the total cost is less than $50,000.

There are a few different ways that companies can go about capitalizing website design costs. The most common method is to capitalize the costs as they are incurred. This means that as soon as the design work starts, the company begins to capitalize on the costs.

Another way that companies can capitalize on website design costs is to amortize the costs over a period of time. This means that the company recognizes the costs over a set time, typically three to five years.

The decision of how to capitalize website design costs is a decision that should be made by the company on a case-by-case basis. There are a number of factors that should be considered when making this decision, including the size of the project, the expected life of the website, and the company’s overall financial picture.

What Documentation Is Needed to Capitalize Website Design Costs?

If you’re in the process of starting a business, you may be wondering what documentation is needed to capitalize website design costs. The answer may vary depending on the accounting method you use and the country in which you do business.

Under the accrual basis of accounting, you generally capitalize costs when you incur them, regardless of when you actually pay for them. This means that if you sign a contract in December for a website to be designed and built in January, you will capitalize on the costs in December.

On the other hand, if you use the cash basis of accounting, you would only capitalize costs when you actually pay for them. So, in the same example, you would not capitalize the costs until January, when you actually paid for the work to be done.

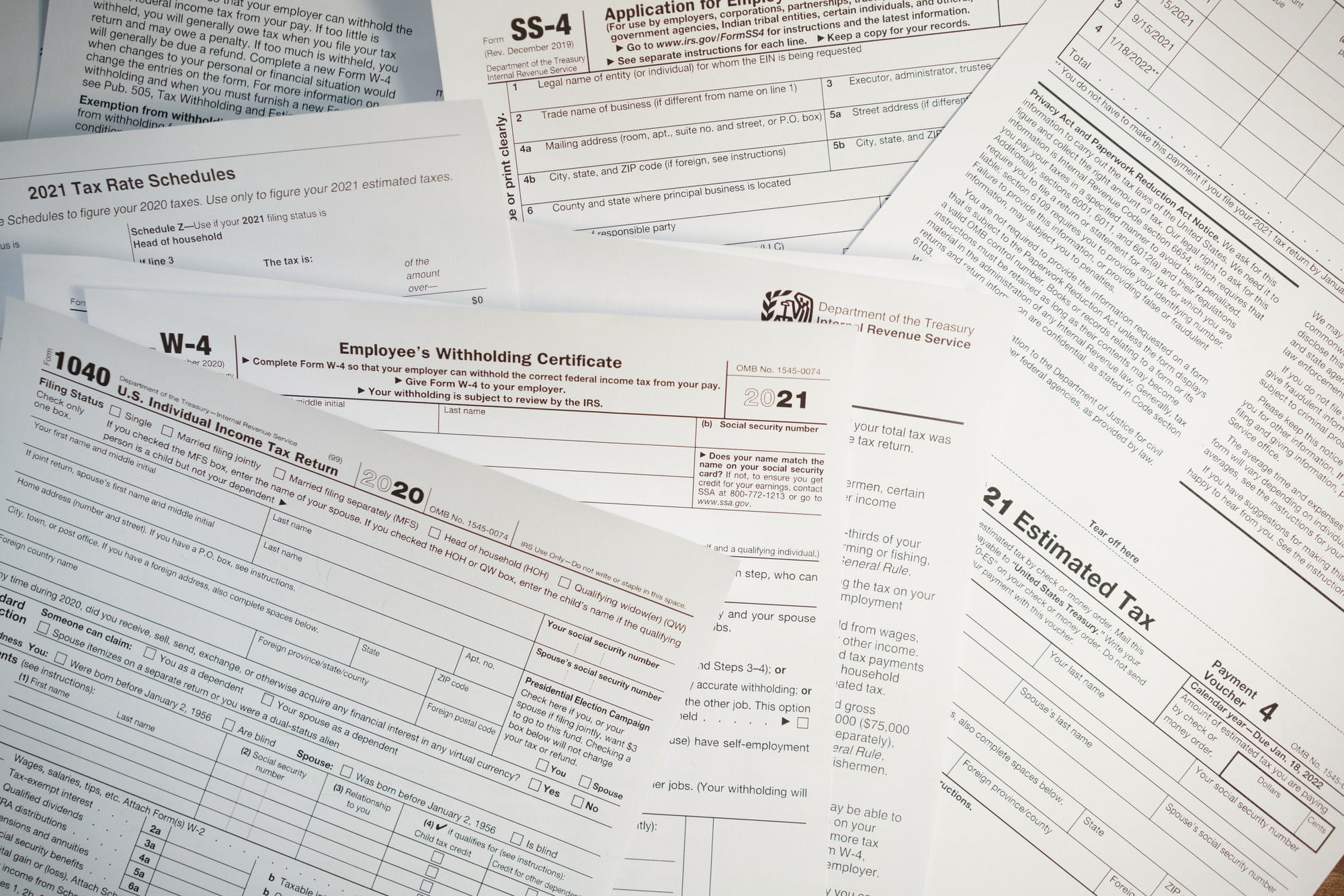

There are a few other factors to consider when deciding whether or not to capitalize on website design costs. For example, in the United States, the Internal Revenue Service (IRS) requires businesses to capitalize certain types of costs, including website design costs, if they meet specific criteria.

In general, the IRS requires businesses to capitalize costs if they are considered “assets” with a useful life of more than one year. Website design costs typically meet this criterion since a business can use a well-designed website for many years.

Another factor to consider is the country in which you do business. In some countries, like Canada, website design costs can be capitalized as “intangible assets.” This means that they can be deducted over a period of time, rather than all at once.

So, what’s the bottom line? If you’re wondering what documentation is needed to capitalize website design costs, it depends on a number of factors, including the accounting method you use and the country in which you do business. Be sure to talk to your accountant or tax advisor to get specific advice for your situation.

How Are Website Design Costs Depreciated?

As a business owner, you understand the importance of depreciation when it comes to capitalizing on website development costs. By depreciating these costs, you can write off a portion of the expense each year, saving you money on your taxes.

But how are website design costs specifically depreciated?

The answer depends on how you account for them. If you capitalized the costs, then you would depreciate them over the life of the asset, which is typically three to five years. This means you would deduct a portion of the costs each year on your taxes.

If you expensed the costs, then you would deduct the entire amount in the year it was incurred. This is often the preferred method because it allows you to deduct the costs in the year you need the deduction the most.

You should speak with your accountant to determine the best method for you and your business. They can help you calculate the depreciation and determine which method will save you the most money on your taxes.

| Aspect | Can Be Capitalized? | Details |

|---|---|---|

| Software Acquisition & Development | Yes | Costs for acquiring or developing software necessary for website operation can be capitalized. |

| Domain Registration | Yes | Costs for domain name registration are capitalizable. |

| Web Application Development | Yes | Costs for developing or customizing software for web applications can be capitalized. |

| Hosting Services | No | Costs for hosting services, typically provided by a third party, are usually expensed over the period received. |

| Ongoing Maintenance & Routine Updates | No | These are generally treated as expenses and not capitalized. |

| Start-Up Costs | No | According to FASB ASC 720-15, start-up costs must be expensed as incurred. |

| Tax Considerations | Depends | The tax treatment might vary and should be considered as per the specific regulations applicable. |

Are There Any GAAP Considerations for Capitalizing Website Design Costs?

Most businesses today have an online presence, and a vital part of that is having a well-designed website. But what are the GAAP considerations for capitalizing website design costs?

To determine whether website design costs can be capitalized, we must first examine what costs can be capitalized under GAAP. Generally, costs can be capitalized if they meet all of the following criteria:

1. They are costs that are necessary and directly related to the acquisition, construction, or production of a long-lived asset.

2. They are costs that can be measured reliably.

3. They are expected to generate economic benefits for the company beyond the current reporting period.

4. They are costs that are not already included in the cost of another long-lived asset.

Based on these criteria, it appears that website design costs could potentially be capitalized. Website design costs meet the first criterion because they are necessary to acquire a long-lived asset (the website). They also meet the second criterion because they can be measured reliably.

As for the third criterion, it is debatable whether website design costs generate economic benefits beyond the current reporting period. One could argue that a well-designed website will bring in more customers and generate more revenue over time, thus providing economic benefits beyond the current reporting period. On the other hand, one could also argue that a website is only used in the current period and does not generate any benefits beyond that, making it ineligible for capitalization.

The fourth criterion is also debatable. In some cases, the cost of designing a website may already be included in the cost of another long-lived asset, such as the cost of developing the company’s overall branding strategy. In other cases, the cost of designing a website may not be included in the cost of another long-lived asset, making it eligible for capitalization.

Ultimately, whether or not website design costs can be capitalized under GAAP is up for interpretation. Some accountants may choose to capitalize on such costs, while others may not. If you are unsure whether to capitalize your website design costs, it is best to consult with a certified public accountant or other financial advisor.

How Are Website Design Costs Recorded in the Financial Statements?

As a business grows, it will eventually need to have a website. This website can be used for a variety of reasons, including but not limited to selling products or services, providing information to customers or suppliers, or simply as a way to increase brand awareness. For a website to be effective, it needs to be designed well. A good website design can be the difference between a website that gets a lot of traffic and one that doesn’t.

The cost of designing a website can vary depending on a number of factors, including the size and complexity of the website, the number of pages, the level of customization, and the designer’s experience. Generally speaking, the cost of designing a website can range from a few hundred dollars to tens of thousands of dollars.

So, how are website design costs recorded in the financial statements?

If a website is being designed for a new business, then the cost of the website design can be recorded as a start-up expense. This means that the cost of the website design will be recorded on the balance sheet as an asset and then amortized over time. Amortization is the process of spreading the cost of an asset over its lifetime.

If a website is being designed for an existing business, then the cost of the website design can be treated as a business expense. This means that the cost of the website design will be recorded on the income statement as an expense in the period in which it is incurred.

In either case, the amortization period for the website design costs will depend on the nature of the website. If the website is expected to generate revenue, then the amortization period will be shorter. If the website is not expected to generate revenue, then the amortization period will be longer.

Website design costs can also be capitalized if they meet certain criteria. To be considered for capitalization, the costs must be incurred in connection with the development or enhancement of an internal-use software application. The costs must also be capitalizable under Generally Accepted Accounting Principles (GAAP).

Some common types of costs that are capitalized for internal-use software applications include:

-Design and coding

-Testing

-Installation

-Training

The costs of designing and developing a website can be significant, but they are an essential part of doing business in the modern world. By understanding how these costs are recorded in the financial statements, businesses can make informed decisions about their website design budgets.

What Are the Tax Implications of Capitalizing Website Design Costs?

When it comes to website design, the question of whether or not costs can be capitalized is a common one. After all, websites are long-term assets – they can be used for years and generate revenue for businesses during that time. So, it stands to reason that the costs associated with designing and building a website should be considered a long-term investment.

However, the answer is not so straightforward. The tax implications of capitalizing website design costs depend on a number of factors, including the specific costs involved and the country in which the website is operated. In general, though, it is possible to capitalize on website design costs – but there may be some limitations.

Let’s take a closer look at what capitalizing website design costs means and what the tax implications might be.

What Does Capitalizing Website Design Costs Mean?

In simple terms, capitalizing website design costs means treating the costs associated with designing and building a website as a long-term investment. This means that, instead of immediately deducting the costs from your business’s taxes, you can spread the deduction out over the asset’s life – in this case, the website.

The main benefit of capitalizing website design costs is that it allows you to deduct more from your taxes in the long run. This can be helpful if your business is in a high tax bracket and cash flow is an issue.

Of course, there are some downsides to capitalizing website design costs as well. For one thing, it means that you have to wait longer to deduct the costs from your taxes. Additionally, if you sell the website before its “useful life” is up, you may have to pay capital gains tax on the sale.

What Are the Tax Implications of Capitalizing Website Design Costs?

As we mentioned above, the tax implications of capitalizing website design costs depend on a number of factors. In general, though, you can expect to deduct a portion of the costs from your taxes each year over the life of the asset.

The specific amount that you can deduct will depend on the country in which you operate your business. In the United States, for example, the Internal Revenue Service (IRS) has a “useful life” guideline for different types of assets. According to this guideline, websites have a useful life of three years. This means that you can deduct 33.33% of the costs from your taxes each year for three years.

Of course, this is just a guideline – you may be able to deduct more or less depending on the specific circumstances of your business. For example, if you sell the website before its “useful life” is up, you may have to pay capital gains tax on the sale.

It’s also important to note that tax laws are constantly changing, so it’s always a good idea to talk to your accountant or tax advisor before making any decisions about how to treat website design costs for tax purposes. They will be able to help you stay up-to-date on the latest changes and make sure you are taking advantage of all the deductions and credits you are entitled to.

Are There Any Alternatives to Capitalizing Website Design Costs?

When it comes to website design, the costs can vary greatly. Depending on the size and complexity of the website, the cost of designing and building it can range from a few hundred dollars to tens of thousands of dollars. For many businesses, the cost of a website is a significant expense.

As with any significant expense, businesses have to decide whether or not to capitalize the cost of their website. There are a few different ways to do this, and each has its own advantages and disadvantages.

One option is to treat the cost of the website as an asset and capitalize it on the balance sheet. This means that the cost of the website would be spread out over its useful life and depreciated accordingly. The advantage of this approach is that it would allow the business to deduct the costs of the website from their taxes.

Another option is to treat the cost of the website as an expense and write it off in the year it is incurred. The advantage of this approach is that it would immediately reduce the taxes that the business has to pay. However, it would also mean that the cost of the website would not be deductible in future years.

The decision of whether or not to capitalize the cost of a website depends on a number of factors, including the size and complexity of the website and the financial situation of the business. In some cases, it may make sense to capitalize the cost of the website, while in others it may be better to expense it.

What Is the Difference Between Capitalizing and Expensing Website Design Costs?

What is the difference between capitalizing and expensing website design costs? This is a question that many business owners and accounting professionals wrestle with. There are pros and cons to both capitalizing and expensing website design costs. The key is to weigh the pros and cons and make the decision that is best for your business.

The main difference between capitalizing and expensing website design costs is that capitalizing costs means adding the costs to the value of your asset (in this case, your website), while expensing means deducting the costs from your income in the current year.

There are a few key considerations to keep in mind when deciding whether to capitalize or expense website design costs:

1. The purpose of the website: If the website is essential to your business operations and generate revenue, it makes sense to capitalize the costs. For example, if you are a retailer and your website is your only sales channel, the website is clearly essential to your business. On the other hand, if you have a brick-and-mortar store and your website is simply an informational site that does not generate revenue, you may want to expense the costs.

2. The expected life of the website: The longer the expected life of the website, the more likely it is that you will want to capitalize the costs. This is because the costs are spread out over a longer period of time, making them less of a burden in any one year. On the other hand, if you expect to redesign or completely rebuild your website every few years, expensing may make more sense.

3. The amount of money you are spending: Obviously, the more money you are spending on your website, the more important it is to carefully consider whether to capitalize or expense the costs. If you are spending a large amount of money on a website that is essential to your business, capitalizing makes sense. But if you are only spending a small amount on a website that is not essential to your business, expensing may be the better option.

In general, capitalizing website design costs makes sense for websites that are essential to your business and have a long expected life. Expensing is a better option for websites that are not essential to your business or have a shorter expected life. Ultimately, the decision of whether to capitalize or expense website design costs comes down to a judgment call based on your specific circumstances.

Key Takeaways for Capitalizing Website Design Costs

As a business owner, you may be wondering if you can capitalize website design costs. The answer is yes, but there are a few key things to keep in mind.

First, it’s important to consider the purpose of the website. If the website is purely for informational purposes, then the costs can be capitalized as part of your company’s overall marketing expenses. However, if the website is designed to generate revenue, then the costs should be capitalized as part of your company’s overall business expenses.

Second, you need to consider the nature of the website design costs. If the costs are for things like developing custom code or designing unique graphics, then those costs can be capitalized. However, if the costs are for things like hosting or maintenance, then those costs should be expensed as they occur.

Third, you need to consider the useful life of the website. If the website is expected to generate revenue for years to come, then the costs can be capitalized. However, if the website is only expected to generate revenue for a short period of time, then the costs should be expensed as they occur.

By keeping these key things in mind, you can make sure that you’re properly accounting for your website design costs.