Setting up tax rates for your WooCommerce store can be tricky, mainly with Canadian taxes. This guide will help you import Canadian tax rates into WooCommerce. We’ll cover GST, HST, and PST, as well as how to use a WooCommerce tax rates plugin and a Canadian GST/HST calculator.

Canadian tax rates differ a lot by province. For example, Alberta has a 5% HST, while British Columbia’s rate is 12% (5% GST and 7% PST). Ontario charges a 13% HST, and Quebec’s total is 14.975% (5% TPS and 9.975% TVQ). E-commerce businesses need to get these rates right in WooCommerce.

To make this easier, you can use a CSV file with the correct tax rates for each province. We’ll show you how to download and import this file into WooCommerce. This way, you follow Canadian tax laws and avoid any financial trouble.

Key Takeaways

- Canadian tax rates vary by province, ranging from 5% to 14.975%

- Importing tax rates using a CSV file simplifies WooCommerce setup

- Accurate tax calculation is crucial for e-commerce compliance

- WooCommerce tax rates plugins can automate the process

- Understanding GST, HST, and PST is essential for Canadian e-commerce

- Tax rates should be based on the shipping destination

To simplify setting up Canadian taxes in WooCommerce, we’ve created an easy-to-use tax import file that includes all the necessary provincial tax rates. Download the file using the link below and follow our step-by-step guide to import it into your WooCommerce store. This ensures your tax calculations are accurate and compliant across Canada. Download the Canadian Tax Import File

Understanding Canadian Tax Structure for E-commerce

Understanding Canadian taxes for e-commerce can be tricky. With different tax rates in each province, automating tax compliance is key. This guide will help you understand Canadian taxes for online sales.

GST, HST, and PST Explained

Canadian sales tax has three main types: Goods and Services Tax (GST), Harmonized Sales Tax (HST), and Provincial Sales Tax (PST). GST is a federal tax of 5%. HST combines federal and provincial taxes. PST rates change by province.

Provincial Tax Rate Variations

Tax rates vary by province, making automation crucial for e-commerce. Some provinces use HST, while others apply GST+PST. Alberta, Northwest Territories, Nunavut, and Yukon only charge 5% GST.

| Province | Tax Type | Rate |

|---|---|---|

| Ontario | HST | 13% |

| New Brunswick | HST | 15% |

| Alberta | GST | 5% |

| British Columbia | GST + PST | 12% (5% + 7%) |

Tax Collection Based on Shipping Destination

E-commerce businesses must collect taxes based on the customer’s shipping address. For example, Ontario-based stores charge 13% HST for Ontario customers but only 5% GST for Alberta buyers. This system needs strong ecommerce sales tax automation to handle different tax rates.

Remember: Canadian businesses must register for a GST/HST number and start charging sales tax once their sales exceed $30,000 CAD in a single calendar quarter.

Import Canadian Tax Rates WooCommerce

Setting up tax rates for cross-border taxation in WooCommerce can be complex, mainly when dealing with Canadian provinces. This guide makes it easier to import Canadian tax rates into your WooCommerce store. It ensures accurate digital goods taxation and smooth woocommerce tax integration.

Downloading the CSV Tax Rate Template

The first step is to get the CSV template. You can find it in your WooCommerce dashboard under Settings > Tax > Standard Rates. Download it to your computer for editing.

Step-by-Step Import Process

Here’s how to import Canadian tax rates:

- Sign into your WordPress admin panel

- Navigate to WooCommerce > Settings > Tax

- Click on “Standard Rates”

- Select “Import CSV”

- Upload your completed CSV file

Make sure to include specific postal codes for certain regions. This ensures precise tax calculations based on shipping destinations.

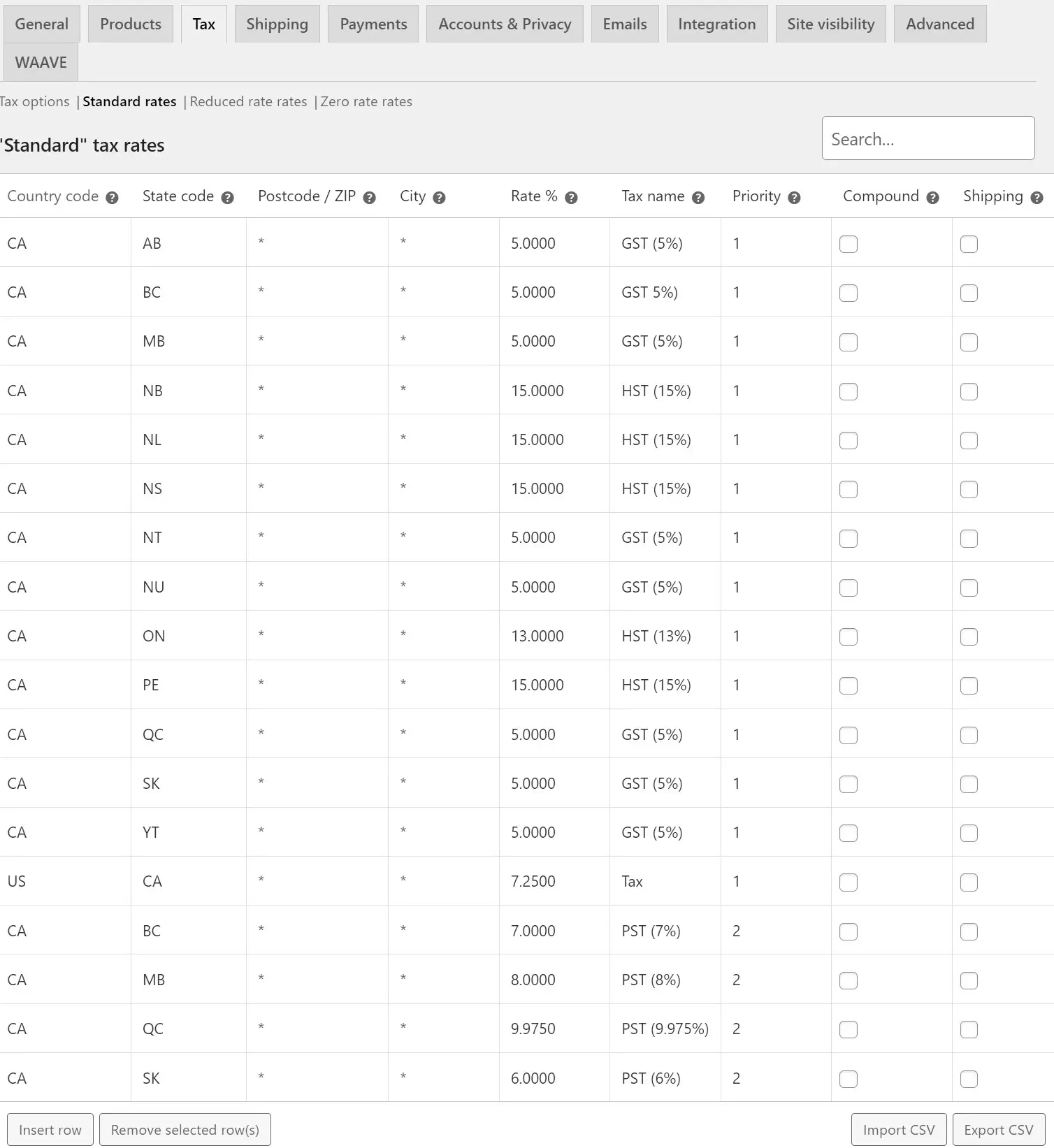

After you upload and import the Canadian tax CSV file, your WooCommerce tax settings will look like this. In this example, the business is located in California, where the business is shipping the products to Canada.

Validating Imported Tax Rates

After importing, it’s important to check the accuracy of your tax rates. Ensure each province has the correct rate applied. Here’s a quick reference table for some Canadian provinces:

| Province | Tax Rate | Breakdown |

|---|---|---|

| Alberta | 5% | GST only |

| British Columbia | 12% | 5% GST + 7% PST |

| Ontario | 13% | HST |

| Quebec | 14.975% | 5% TPS + 9.975% TVQ |

Following these steps and checking your rates will ensure accurate cross-border taxation for your WooCommerce store. This simplifies digital goods taxation across Canadian provinces.

Configuring WooCommerce Tax Settings

Setting up tax calculations in WooCommerce is key for managing taxes well. The platform has four tax settings pages. These let you tailor your tax setup for different situations.

Enabling Tax Calculations

To begin, go to Settings > General. Then, select “Enable Taxes and Tax Calculations.” This turns on WooCommerce’s tax features. It gets your store ready to handle taxes.

Setting Up Tax Display Options

WooCommerce lets you decide how prices are shown. You can choose to include or exclude tax. This meets different customer needs and legal rules.

Managing Tax Classes and Rates

WooCommerce has three default tax classes: Standard, Reduced, and Zero. You can set tax rates for each class. Use ISO 3166-1 alpha-2 codes to identify locations.

| Tax Class | Example Rate | Application |

|---|---|---|

| Standard | 20.0000% | General products |

| Reduced | 5.0000% | Specific goods |

| Zero | 0.0000% | Tax-exempt items |

Price Display Configuration

Set how prices look on your site. You can show prices with or without tax. You can also add suffixes to show tax inclusion. The WooCommerce tax rates plugin makes this easier, helping businesses in supported countries.

Advanced Tax Management Solutions

Managing taxes for your online store can be complex, with many jurisdictions to consider. Luckily, advanced solutions can make this easier. Automated tax compliance tools are key for ecommerce businesses looking to simplify their tax duties.

Ecommerce sales tax automation brings big benefits to WooCommerce store owners. These tools can automatically figure out taxes based on where customers are. They also apply the right rates and update in real-time as tax laws change. This keeps your taxes accurate and up-to-date without manual updates.

Let’s look at some important features of advanced tax management solutions:

- Automatic tax calculations based on geolocation

- Real-time updates to tax rates and rules

- Support for multiple tax jurisdictions

- Integration with popular ecommerce platforms

- Detailed reporting for tax filing purposes

For WooCommerce, options like Jetpack and WooCommerce Tax are popular. They work well with your store, offering automated tax services that are easy to turn on in your settings.

| Feature | Manual Setup | Automated Solution |

|---|---|---|

| Tax Rate Updates | Manual, time-consuming | Automatic, real-time |

| Accuracy | Prone to human error | High precision |

| Time Investment | High | Low |

| Compliance Risk | Higher | Lower |

Using these advanced tax management solutions lets you grow your business. You can focus on growth while keeping taxes in check across different places.

Conclusion

Learning how to import Canadian tax rates in WooCommerce is key for e-commerce success. This guide has shown you how to handle the complex Canadian tax system. This includes GST, HST, and PST.

You can meet provincial rate requirements by following the steps and setting up tax settings right. This ensures you’re following the rules.

Managing taxes in WooCommerce is more than just importing rates. You also need to understand how to display taxes, manage tax classes, and set up prices. These steps help create a smooth tax system based on where items are shipped.

While you can do this manually, using advanced tax management tools can make it easier. These tools handle calculations and keep you up to date with tax law changes. Remember, good tax management builds trust with customers and avoids legal trouble.

When you start using these strategies, think about getting advice from tax experts. They can give you advice that fits your business. With the right approach, tax compliance can be a way to stand out in the Canadian e-commerce world.

FAQ

How do I import Canadian tax rates into WooCommerce?

What are the different types of Canadian taxes I need to consider for e-commerce?

How do I determine which tax rate to charge for different provinces?

How can I enable tax calculations in WooCommerce?

Are there automated solutions for managing Canadian taxes in WooCommerce?

How often should I update my tax rates in WooCommerce?

Can WooCommerce handle cross-border taxation for Canadian e-commerce businesses?

How do I handle digital goods taxation in WooCommerce for Canadian sales?

Source Links

- Import Canadian Tax Rates into WooCommerce – Guide

- WooCommerce EU tax rates – Download Ready-to-Import CSV file

- How to Import Canadian Tax Rates into WooCommerce

- No tax in Woocommerce? Here’s the fix! | DataRoots Business Solutions Inc.

- How to configure specific tax setups in WooCommerce

- Charging Sales Tax to Canadian Customers | ShipHype

- Import Canadian Tax Rates into WooCommerce – Guide

- GoDaddy – Set up WooCommerce tax settings

- Set up Sales Tax on Woo: Default Functionality & Advanced Tools

- WooCommerce Tax

- Setting up Taxes in WooCommerce

- How To Set Up Taxes On Your WooCommerce Website? | Canadian Development Technology

- How to Add VAT in WooCommerce: A Step-by-Step Guide

- How To Configure WooCommerce Tax Rate Settings? [2024]

- How to Configure Tax Settings in WooCommerce